Innovation within Electrical Engineering

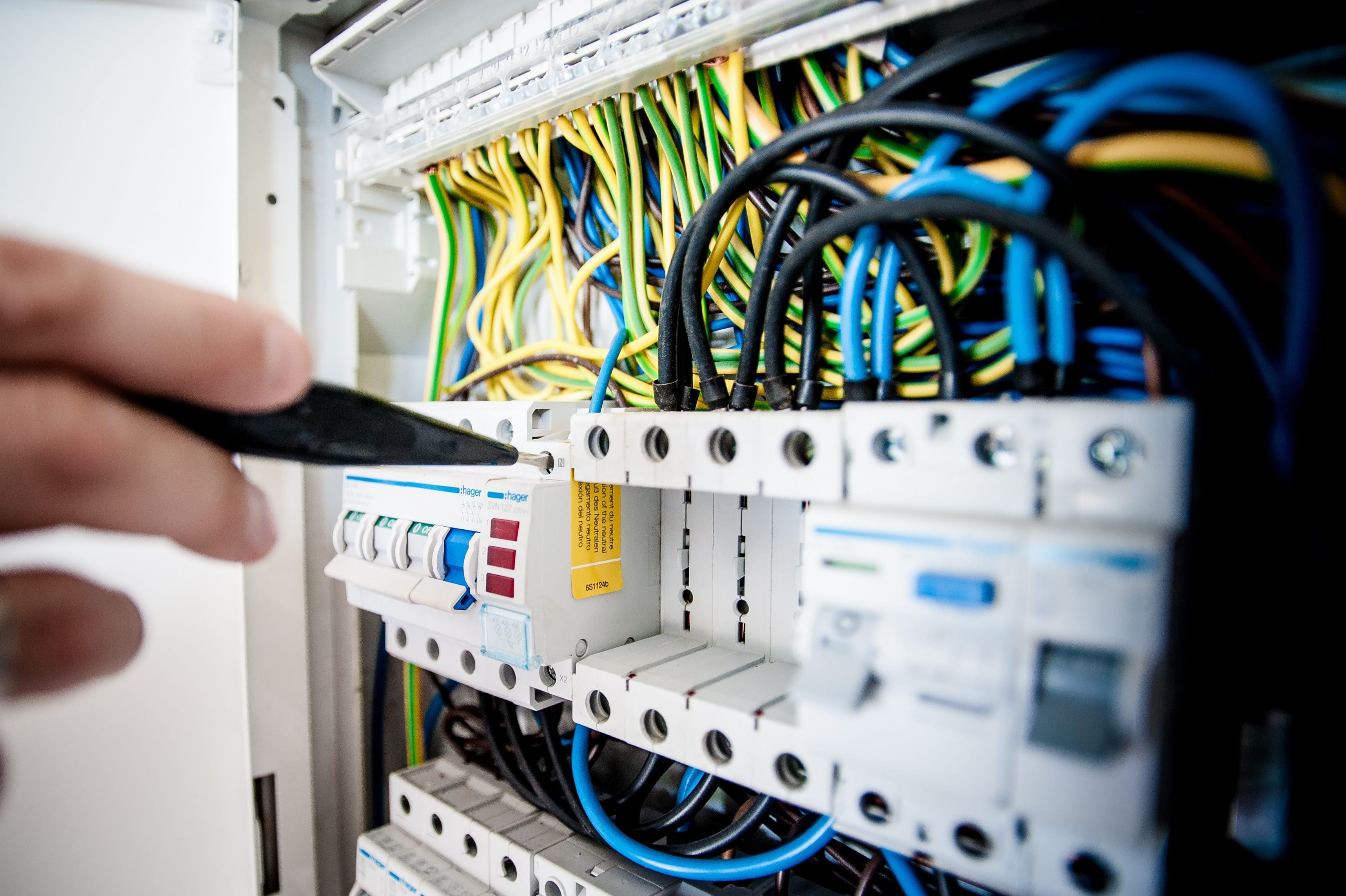

Electrical engineering is at the forefront of innovation in the UK, responsible for developments such as advanced robotics and new approaches to building control systems.

Many of these innovations come about as a result of a need to overcome a problem or advance understanding, and the work that goes into them often qualifies for research and development (R&D) tax credits.

Electrical engineering firms recognise technical uncertainty and develop complex and innovative solutions regularly, which means a particularly large proportion of their work is eligible for tax relief. If you are in any doubt as to whether the work of your own electrical engineering company qualifies for tax credits, speak to an expert before submitting an application.

Examples of eligible activities

- Designing innovative control systems

- Researching new uses for materials

- Developing more efficient power systems

- Researching energy-efficient alternatives

- Bespoke modifications of existing equipment

- Developing safer methods and practices

- Creating innovative fire control systems

When a supermarket wished to integrate its heating, cooling, lighting and communication systems, an electrical engineering company was tasked with finding a solution.

The combination of disparate systems had not previously been integrated in such a way, so the firm faced significant technical uncertainty. After extensive R&D into a new building management system, the company was able to design a solution that met the projects needs.