Examples of Sector Specific R&D

There’s huge scope for advancement across all sectors. From reducing waste that would otherwise end up in landfill, to creating more efficient manufacturing techniques. What qualifying R&D activities is your business conducting?

The aerospace industry is a very diverse and innovative sector, covering many aspects such as manufacturing, research, design and production. Despite all this activity, many aviation companies fail to check how much of this is actually eligible for R&D tax relief, and miss out on large rebates.

Companies are missing out on valuable tax incentives, as they wrongly believe R&D is only carried out by scientists in labs. Claims submitted by the agricultural industry is way below the national average. In 2017, less than 1% of the total claims submitted by UK businesses came from this sector.

Developing the latest designs and using new materials has always being looked upon to find innovative solutions to structural problems. This makes the architecture industry extremely innovative, but a number of architectural companies are still not claiming their entitled tax relief.

It’s estimated that eligible R&D in the construction industry could be worth over £1 billion in tax credits annually. There’s huge amount of innovation in the sector, but the industry’s culture is stopping companies from claiming. Looking into what counts as R&D for your company could be worth your while.

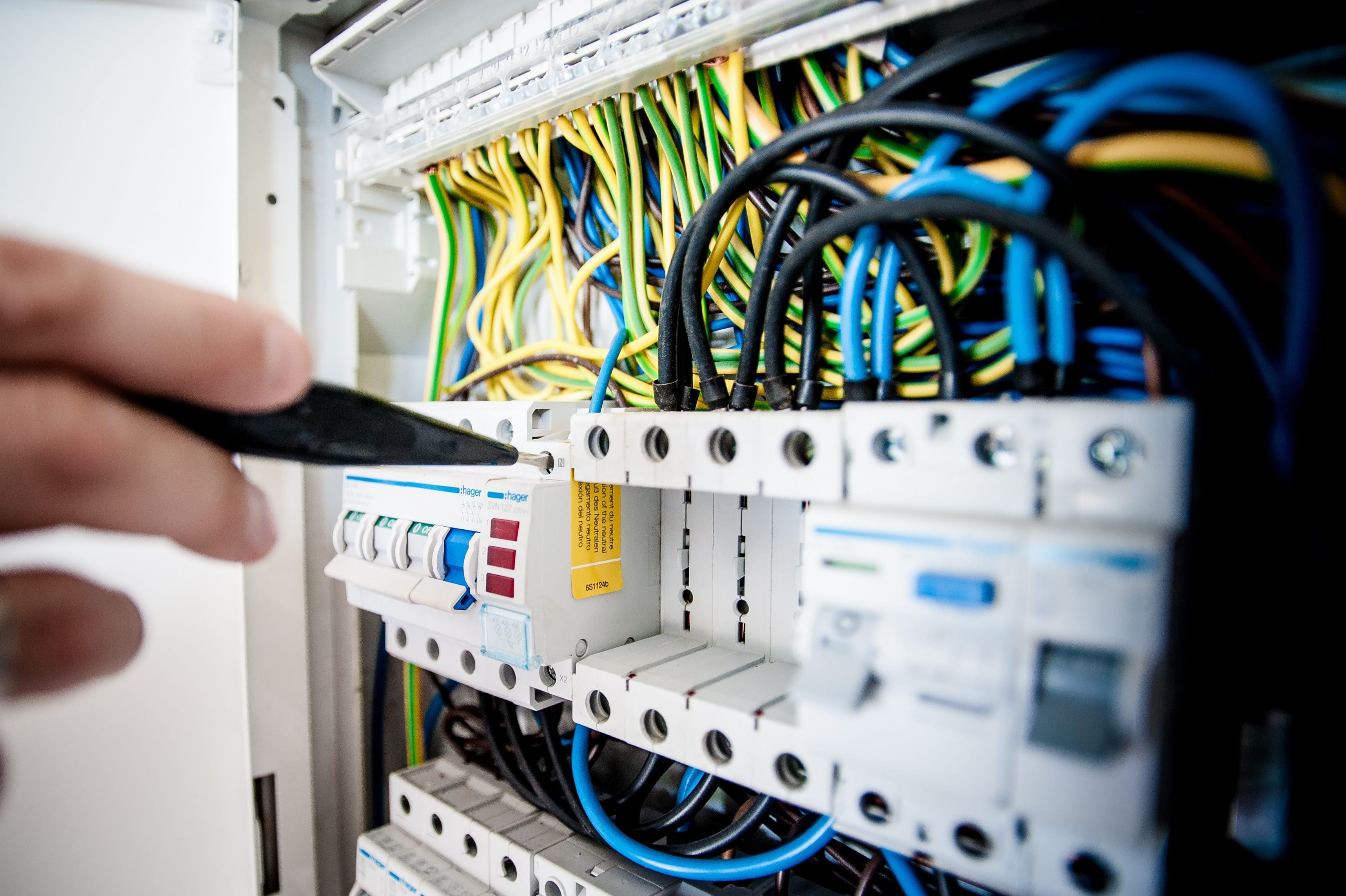

Electrical contractors are doing R&D on a daily basis, but don’t realise it qualifies for tax relief as it’s not directly labelled as R&D. Activity that involves providing solutions, advancing technology or making appreciable improvements qualify. We have the expertise to identify what is considered eligible.

Companies are always looking for innovative ways to increase performance, productivity and efficiency without impacting the environment. The processes involved in developing eco-friendly products is costly and labour intensive. Companies involved in these activities could benefit from R&D tax relief.

R&D in the hospitality sector is usually overlooked because, while innovation is happening daily, many in the industry are unaware if they qualify for a claim. If you are a restaurant owner or in the industry and developing new recipes, improved techniques or services, or some other innovation, we are here to help.

With so much room for progressive thinking and complex problem solving across all sub sectors of the maritime sector, the scope for receiving R&D Tax relief is huge. Maritime SMEs should focus on unlocking their R&D to help secure their own growth and drive UK marine advancements forward even further.

The manufacturing industry is leading the way in claiming R&D tax relief and contributes massively to UK growth. We have a sophisticated understanding of R&D tax credits, which means we know exactly who to talk to and what questions to ask. All you need to do is connect us with the right people and departments in your business. We’ll do the rest.

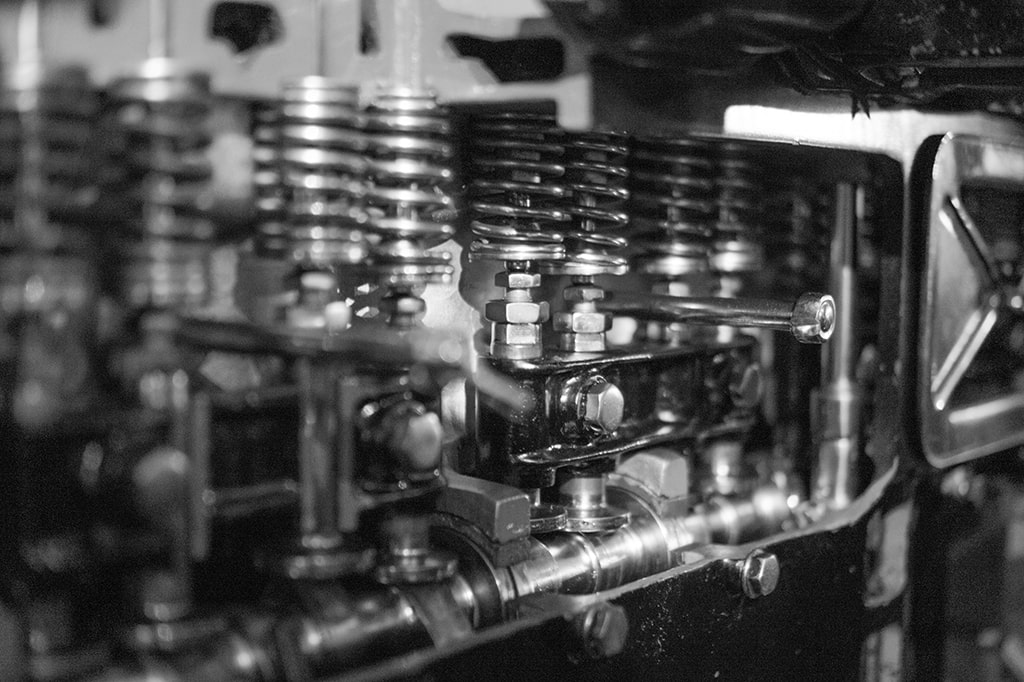

Eligible R&D for engineering firms can include anything from updating safety processes, to developing new techniques, and a wide range of other activities in between. We have the expertise to help identify what is considered eligible. Looking into what R&D counts for your mechanical engineering firm might be worth your while.

The extent of R&D undertaken in the healthcare and scientific sector is one of the most extensive in any given industry. Because medical development stems from scientific research, the activities involved often qualify for R&D tax relief. Unfortunately, there are still companies in this sector that fail to look into this and benefit from the initiative.

The software sector is a fast evolving and innovative industry when it comes to technological advancements. If you are a software consultancy business or you outsource your software development needs, it is worth looking into R&D tax relief and whether this is applicable to your software activities.